record the entry to close the temporary revenue accounts

The Account Motorbike And Closing Process

Reflecting connected the accounting processes thus far represented reveals the following typical steps:

- transactions are recorded in the diary

- daybook entries are posted to appropriate boo accounts

- a trial counterweight is constructed

- adjusting entries are spread and posted

- an adjusted test balance is prepared

- formal financial statements are produced (perhaps with the assistance of a worksheet)

IT appears that the accounting cycle is complete by capturing transaction and outcome information and moving information technology through an orderly process that results in the output of useful financial statements. Importantly, one is left with substantial records that document each transaction (the journal) and to each one account's activity (the ledger). It is no wonder that the basic elements of this accounting methodological analysis take over endured for hundreds of years.

There remains one final physical process called the closing process . Closing has two objectives:

Objective 1: Update Retained Earnings

Closing is a chemical mechanism to update the Retained Earnings account in the daybook to equal the end-of-period balance. Keep in mind that the recording of revenues, expenses, and dividends do not automatically produce an updating debit or credit to Retained Earnings. In and of itself, the showtime- of-period retained earnings total remains in the ledger until the closing process "updates" the Maintained Earnings account for the bear on of the period's operations.

Objective 2: Reset Makeshift Accounts

Revenues, expenses, and dividends represent amounts for a period of clock time; unrivaled must "zero out" these accounts at the conclusion of each catamenia (as a result, revenue, expense, and dividend accounts are called temporary Oregon

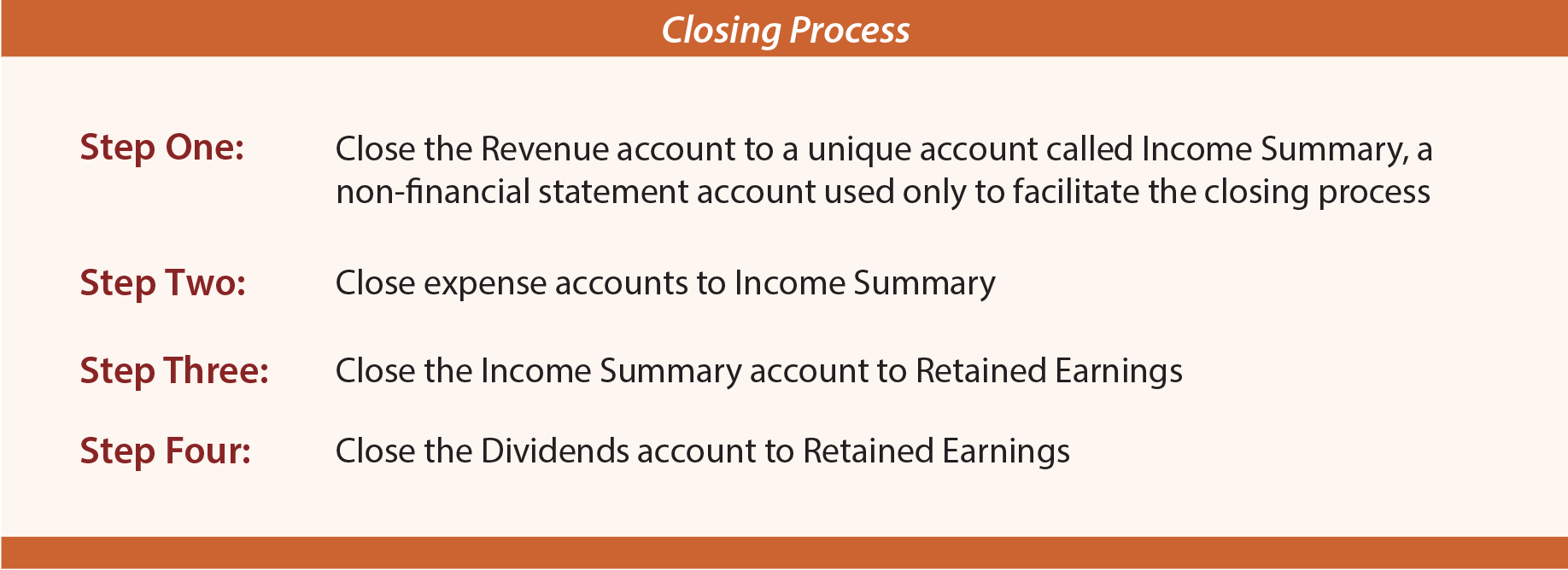

Closing involves a quaternary-step process:

This process results in all revenues and expenses beingness "corralled" in Income Summary (the cyberspace of which represents the income or loss for the period). In turn, the income operating room red ink is and so swept to Retained Remuneration along with the dividends. Recall that opening retained earnings, plus income, less dividends, equals ending retained net; likewise, the closing process updates the beginning retained earnings to move forward to the end-of-period balance.

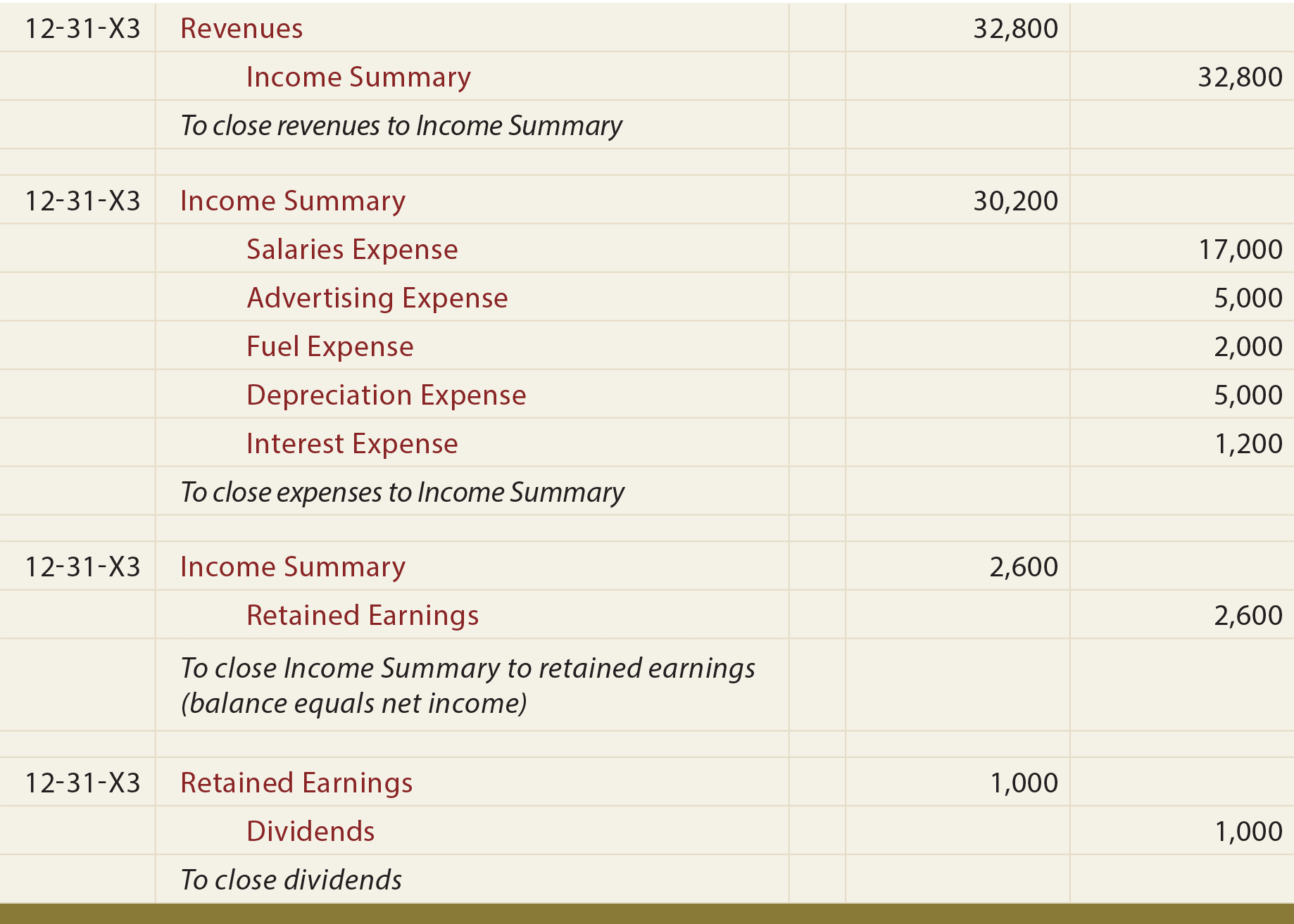

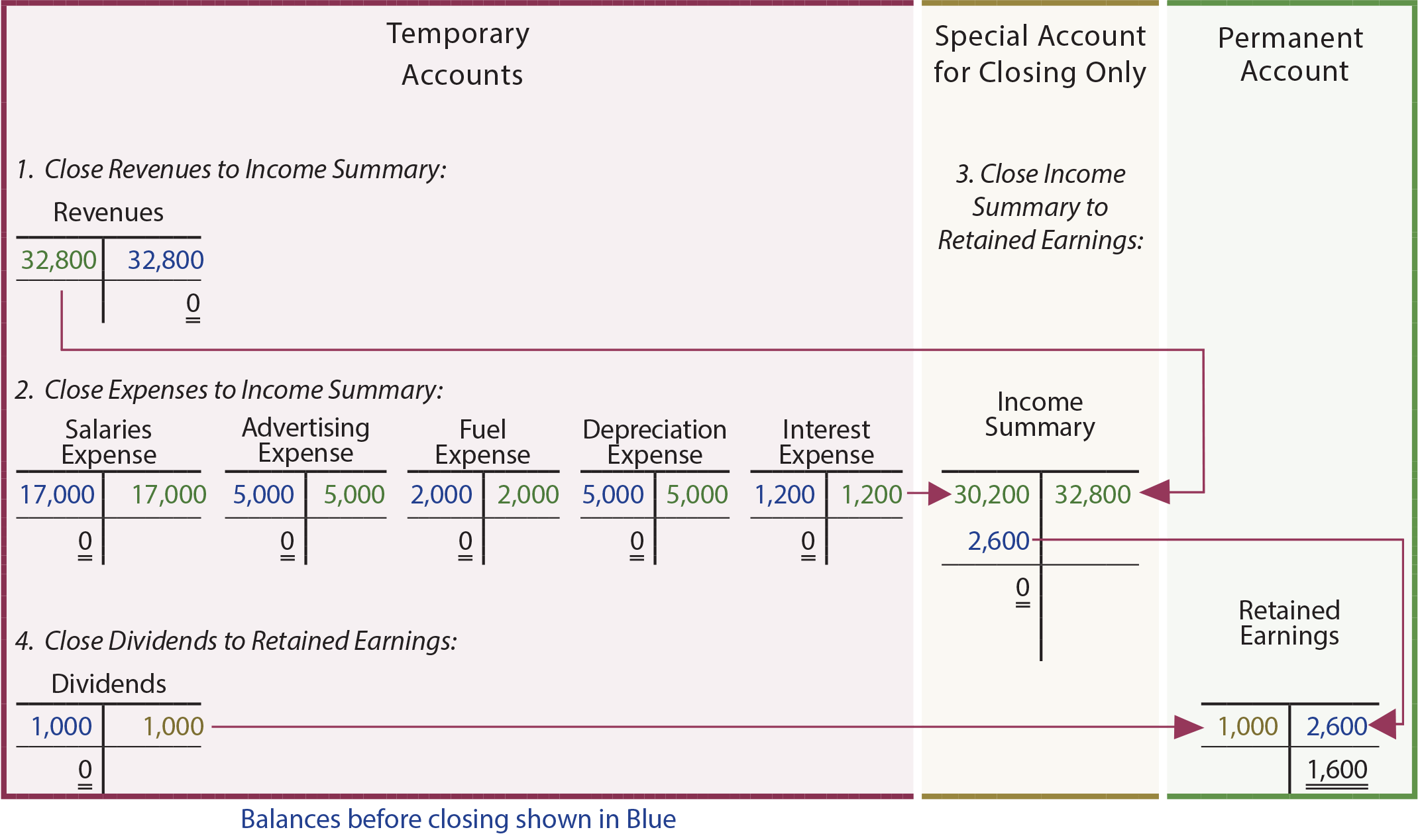

Chase are the closing entries for England Tours for 20X3. Compare the accounts and amounts to those that appeared in the 20X3 adjusted tribulation balance:

The effect of the to a higher place entries is to update the Retained Earnings describe and cause a zero balance to hap in the temporary accounts. The Income Summary account is also "zeroed" prohibited ($32,800 (cr.) = $30,200 (dr.) + $2,600 (dr.)). The following T-accounts reveal the effects of the closing entries:

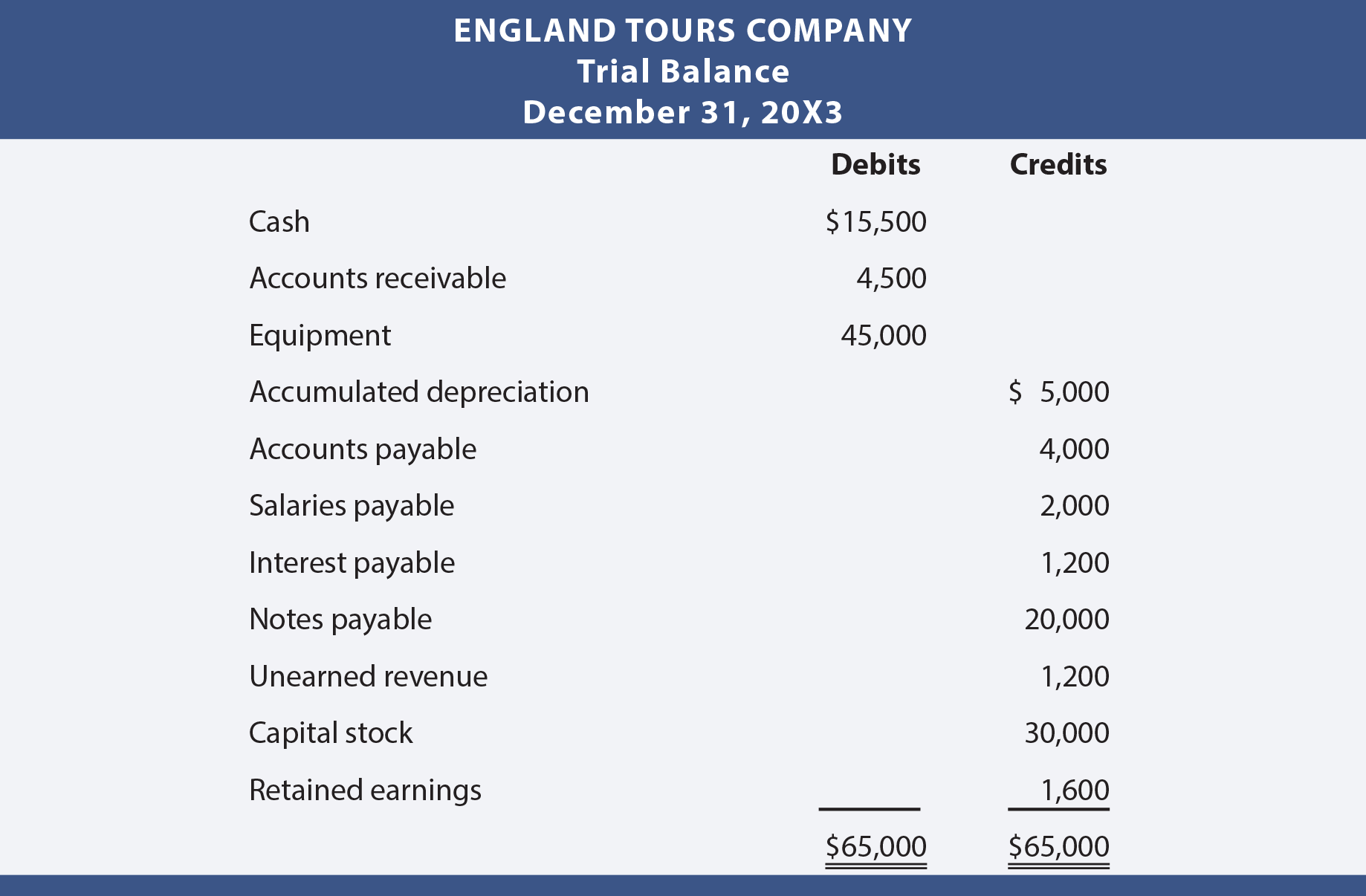

Post-Closing Trial Balance

The situatio closing trial balance reveals the balance of accounts after the closing process, and consists of balance sheet accounts only. The post-closing trial balance is a creature to demonstrate that accounts are in balance; information technology is not a formal financial statement. Every of the revenue, disbursal, and dividend accounts were zeroed absent via closing, and do not appear in the post-closing trial balance.

Revisiting Software

Numerous accountancy software program programs are based on database logic. These powerful tools allow the user to query with few restrictions. Equally such, one could quest business enterprise results for nearly some period of time (e.g., the 45 days termination October 15, 20XX), even if it related to a full stop several years ago. In these cases, the notion of closing the accounts becomes farther less relevant. Very simply, the computer can mine all dealings data and pull the accounts and amounts that interrelate to virtually any requested musical interval of clock.

Need help preparing for an exam?

Agree out ExamCram the exam preparation tool!

| Did you get a line? |

|---|

| Articulate the steps in a the accounting cycle process. |

| When and wherefore are the books "closed?" |

| Define temporary (nominal) and historical accounts. |

| Be able to prepare year-end entries associated revenues, expenses, the Income Compendious, and the Dividend account. |

| What welfare is a post-closing trial run balance, and what type of accounts would be establish there? |

record the entry to close the temporary revenue accounts

Source: https://www.principlesofaccounting.com/chapter-4/the-accounting-cycle-and-closing-process/

Posting Komentar untuk "record the entry to close the temporary revenue accounts"